"This article written by Paul Graham in 2010 offers an in-depth look at how time and money are wasted. Graham points out that the majority of paths from wealth to poverty stem not from excessive spending, but from bad investments. He also focuses on ""fake jobs"" that seem like real work but actually cause a waste of time. Graham emphasizes that we need alarm systems more complex than our instincts to protect both our time and money. This article provides a thought-provoking perspective on money and time management.

---

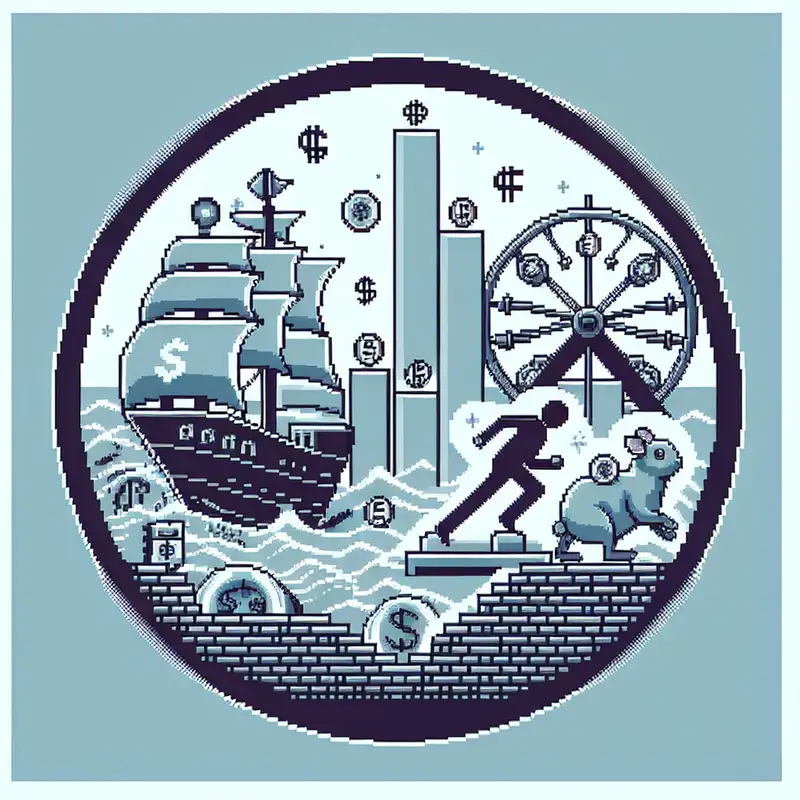

# How to Lose Time and Money (The Downward Spiral from Wealth to Poverty: Bad Investments and Fraudulent Schemes)

July 2010

When we sold our startup in 1998 I suddenly got a lot of money. I now had to think about something I hadn't had to think about before: how not to lose it. I knew it was possible to go from rich to poor, just as it was possible to go from poor to rich. But while I'd spent a lot of the past several years studying the paths from [poor to rich](wealth.html), I knew practically nothing about the paths from rich to poor. Now, in order to avoid them, I had to learn where they were.

So I started to pay attention to how fortunes are lost. If you'd asked me as a kid how rich people became poor, I'd have said by spending all their money. That's how it happens in books and movies, because that's the colorful way to do it. But in fact the way most fortunes are lost is not through excessive expenditure, but through bad investments.

It's hard to spend a fortune without noticing. Someone with ordinary tastes would find it hard to blow through more than a few tens of thousands of dollars without thinking ""wow, I'm spending a lot of money."" Whereas if you start trading derivatives, you can lose a million dollars (as much as you want, really) in the blink of an eye.

In most people's minds, spending money on luxuries sets off alarms that making investments doesn't. Luxuries seem self-indulgent. And unless you got the money by inheriting it or winning a lottery, you've already been thoroughly trained that self-indulgence leads to trouble. Investing bypasses those alarms. You're not spending the money; you're just moving it from one asset to another. Which is why people trying to sell you expensive things say ""it's an investment.""

The solution is to develop new alarms. This can be a tricky business, because while the alarms that prevent you from overspending are so basic that they may even be in our DNA, the ones that prevent you from making bad investments have to be learned, and are sometimes fairly counterintuitive.

A few days ago I realized something surprising: the situation with time is much the same as with money. The most dangerous way to lose time is not to spend it having fun, but to spend it doing fake work. When you spend time having fun, you know you're being self-indulgent. Alarms start to go off fairly quickly. If I woke up one morning and sat down on the sofa and watched TV all day, I'd feel like something was terribly wrong. Just thinking about it makes me wince. I'd start to feel uncomfortable after sitting on a sofa watching TV for 2 hours, let alone a whole day.

And yet I've definitely had days when I might as well have sat in front of a TV all day — days at the end of which, if I asked myself what I got done that day, the answer would have been: basically, nothing. I feel bad after these days too, but nothing like as bad as I'd feel if I spent the whole day on the sofa watching TV. If I spent a whole day watching TV I'd feel like I was descending into perdition. But the same alarms don't go off on the days when I get nothing done, because I'm doing stuff that seems, superficially, like real work. Dealing with email, for example. You do it sitting at a desk. It's not fun. So it must be work.

With time, as with money, avoiding pleasure is no longer enough to protect you. It probably was enough to protect hunter-gatherers, and perhaps all pre-industrial societies. So nature and nurture combine to make us avoid self-indulgence. But the world has gotten more complicated: the most dangerous traps now are new behaviors that bypass our alarms about self-indulgence by mimicking more virtuous types. And the worst thing is, they're not even fun.

**Thanks** to Sam Altman, Trevor Blackwell, Patrick Collison, Jessica Livingston, and Robert Morris for reading drafts of this.

---

Relevant Keywords: wealth management, avoiding financial loss, bad investments, spending vs investing, time management, productivity, avoiding unproductive work, self-indulgence and wealth, managing time and money, wealth preservation, dangers of fake work, understanding investment risks."

Episode 78

Episode 78