"This article written by Paul Graham in 2015 highlights the potential dangers of speaking with the Corporate Development (Corp Dev) department, which is responsible for acquiring companies. Graham suggests that founders often risk being led to consider selling their companies and facing significant disruption by engaging with this department. He argues about the length of these discussions, how distracting they can be, and that they often result in a low offer. Graham asserts that speaking with Corporate Development is only suitable for those considering selling their company or those in a situation that is going very well or very poorly.

---

# Don't Talk to Corp Dev (Avoiding Discussions with Corporate Development if You're Not Planning to Sell Your Business)

January 2015

Corporate Development, aka corp dev, is the group within companies that buys other companies. If you're talking to someone from corp dev, that's why, whether you realize it yet or not.

It's usually a mistake to talk to corp dev unless (a) you want to sell your company right now and (b) you're sufficiently likely to get an offer at an acceptable price. In practice that means startups should only talk to corp dev when they're either doing really well or really badly. If you're doing really badly, meaning the company is about to die, you may as well talk to them, because you have nothing to lose. And if you're doing really well, you can safely talk to them, because you both know the price will have to be high, and if they show the slightest sign of wasting your time, you'll be confident enough to tell them to get lost.

The danger is to companies in the middle. Particularly to young companies that are growing fast, but haven't been doing it for long enough to have grown big yet. It's usually a mistake for a promising company less than a year old even to talk to corp dev.

But it's a mistake founders constantly make. When someone from corp dev wants to meet, the founders tell themselves they should at least find out what they want. Besides, they don't want to offend Big Company by refusing to meet.

Well, I'll tell you what they want. They want to talk about buying you. That's what the title ""corp dev"" means. So before agreeing to meet with someone from corp dev, ask yourselves, ""Do we want to sell the company right now?"" And if the answer is no, tell them ""Sorry, but we're focusing on growing the company."" They won't be offended. And certainly the founders of Big Company won't be offended. If anything they'll think more highly of you. You'll remind them of themselves. They didn't sell either; that's why they're in a position now to buy other companies. [1]

Most founders who get contacted by corp dev already know what it means. And yet even when they know what corp dev does and know they don't want to sell, they take the meeting. Why do they do it? The same mix of denial and wishful thinking that underlies most mistakes founders make. It's flattering to talk to someone who wants to buy you. And who knows, maybe their offer will be surprisingly high. You should at least see what it is, right?

No. If they were going to send you an offer immediately by email, sure, you might as well open it. But that is not how conversations with corp dev work. If you get an offer at all, it will be at the end of a long and unbelievably distracting process. And if the offer is surprising, it will be surprisingly low.

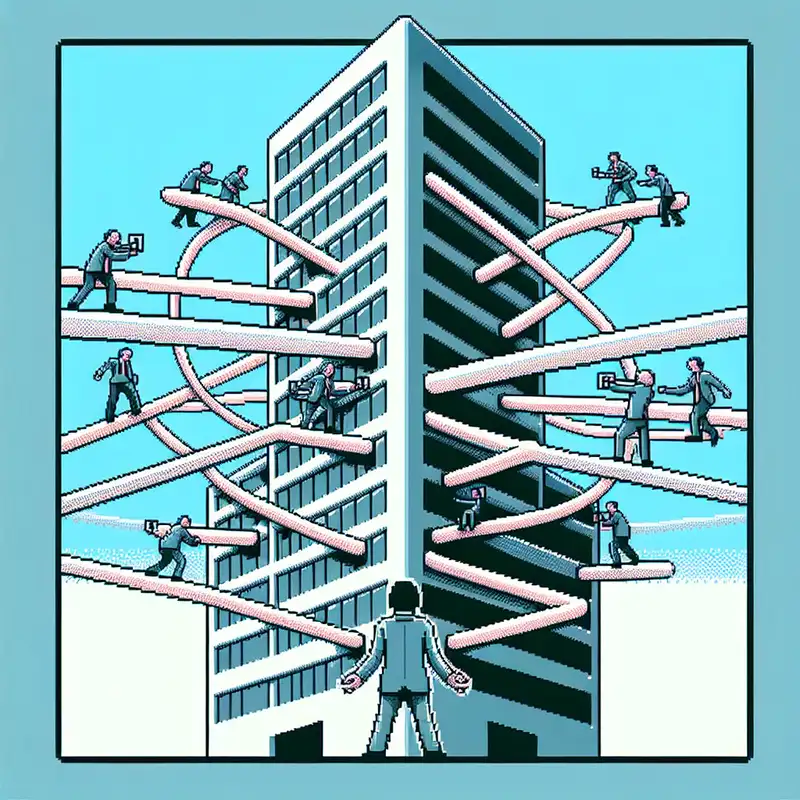

Distractions are the thing you can least afford in a startup. And conversations with corp dev are the worst sort of distraction, because as well as consuming your [attention](top.html) they undermine your morale. One of the tricks to surviving a grueling process is not to stop and think how tired you are. Instead you get into a sort of flow. [2] Imagine what it would do to you if at mile 20 of a marathon, someone ran up beside you and said ""You must feel really tired. Would you like to stop and take a rest?"" Conversations with corp dev are like that but worse, because the suggestion of stopping gets combined in your mind with the imaginary high price you think they'll offer.

And then you're really in trouble. If they can, corp dev people like to turn the tables on you. They like to get you to the point where you're trying to convince them to buy instead of them trying to convince you to sell. And surprisingly often they succeed.

This is a very slippery slope, greased with some of the most powerful forces that can work on founders' minds, and attended by an experienced professional whose full time job is to push you down it.

Their tactics in pushing you down that slope are usually fairly brutal. Corp dev people's whole job is to buy companies, and they don't even get to choose which. The only way their performance is measured is by how cheaply they can buy you, and the more ambitious ones will stop at nothing to achieve that. For example, they'll almost always start with a lowball offer, just to see if you'll take it. Even if you don't, a low initial offer will demoralize you and make you easier to manipulate.

And that is the most innocent of their tactics. Just wait till you've agreed on a price and think you have a done deal, and then they come back and say their boss has vetoed the deal and won't do it for more than half the agreed upon price. Happens all the time. If you think investors can behave badly, it's nothing compared to what corp dev people can do. Even corp dev people at companies that are otherwise benevolent.

I remember once complaining to a friend at Google about some nasty trick their corp dev people had pulled on a YC startup.

What happened to Don't be Evil? I asked.

I don't think corp dev got the memo, he replied.

The tactics you encounter in M&A conversations can be like nothing you've experienced in the otherwise comparatively [upstanding](mean.html) world of Silicon Valley. It's as if a chunk of genetic material from the old-fashioned robber baron business world got incorporated into the startup world. [3]

The simplest way to protect yourself is to use the trick that John D. Rockefeller, whose grandfather was an alcoholic, used to protect himself from becoming one. He once told a Sunday school class

> Boys, do you know why I never became a drunkard? Because I never took the first drink.

Do you want to sell your company right now? Not eventually, right now. If not, just don't take the first meeting. They won't be offended. And you in turn will be guaranteed to be spared one of the worst experiences that can happen to a startup.

If you do want to sell, there's another set of [techniques](https://justinkan.com/the-founders-guide-to-selling-your-company-a1b2025c9481) for doing that. But the biggest mistake founders make in dealing with corp dev is not doing a bad job of talking to them when they're ready to, but talking to them before they are. So if you remember only the title of this essay, you already know most of what you need to know about M&A in the first year.

#### Notes

[1] I'm not saying you should never sell. I'm saying you should be clear in your own mind about whether you want to sell or not, and not be led by manipulation or wishful thinking into trying to sell earlier than you otherwise would have.

[2] In a startup, as in most competitive sports, the task at hand almost does this for you; you're too busy to feel tired. But when you lose that protection, e.g. at the final whistle, the fatigue hits you like a wave. To talk to corp dev is to let yourself feel it mid-game.

[3] To be fair, the apparent misdeeds of corp dev people are magnified by the fact that they function as the face of a large organization that often doesn't know its own mind. Acquirers can be surprisingly indecisive about acquisitions, and their flakiness is indistinguishable from dishonesty by the time it filters down to you.

**Thanks** to Marc Andreessen, Jessica Livingston, Geoff Ralston, and Qasar Younis for reading drafts of this.

---

Relevant Keywords: corporate development, selling a startup, dealing with corp dev, startup acquisition, startup distractions, startup morale, negotiation tactics in M&A, startup growth, startup decision making, when to sell your company, startup manipulation, corp dev tactics, Silicon Valley M&A practices, startup founder advice"

Episode 43

Episode 43